What You Need to Know About Opportunity Zones

Buried deep within the new ‘2017 Tax Cuts and Jobs Act’ is a tax incentive for investment in Qualified Opportunity Zones (QOZ). This may be the single most significant wealth building opportunity for anyone realizing capital gains from the sale of real estate, stocks, bonds or even a business. Perhaps the equivalent of the 1031 exchange rules on steroids, it offers not only a tax deferral on the capital gain, but also a tax reduction and permanent tax exemption on the new investment.

The reality is that there are a number of ways in which you can save money by engaging a mortgage broker to provide assistance with your commercial real estate financing needs and objectives. If you take the time to determine the value of using a commercial mortgage broker, you will surely see that it is money well spent. Locating a Lender Risks in working with a Single Lender Cost Variations between Lenders Support Services Fees of Commercial Mortgage Brokers

- What Qualifies as an Opportunity Zone Investment?

- Each state can designate a quarter of its eligible low-income communities as Opportunity Zones under the Tax Act. Qualified Opportunity Zones are intended to encourage investments that will be used to start businesses, develop abandoned properties or provide low-income housing in distressed communities. Under the program, taxpayers are able to invest their capital gains into a third-party Qualified Opportunity Fund or a self-directed Fund within 180 days of recognizing the capital gain, thereby deferring the tax on the capital gain to December 31, 2026 (see Deferral Election below). The longer the funds stay invested, the larger the tax savings. This tax incentive is intended to help “areas in need of redevelopment” attract capital.

- What Qualifies as an Opportunity Zone Property?

- • An equity interest in an entity that is a US corporation, partnership or LLC that is a Qualified Opportunity Zone Business. During substantially all of the time that the Qualified Opportunity Fund holds the equity interest, the entity must qualify as a Qualified Opportunity Zone Business which cannot include golf courses, country clubs, massage parlors, hot tub facilities, racetracks or other facilities used for gambling, or any stores where the principal business is the sale of alcoholic beverages for off premise consumption; and • Tangible property (real estate) acquired by a Qualified Opportunity Fund after December 31, 2017 which is substantially improved. Property is treated as substantially improved only if the capital expenditures made with respect to the property in the 30 months after its acquisition by the Opportunity Fund exceed the purchase price for the property. Property does not qualify as a Qualified Opportunity Zone Property if it is acquired from a related person (20% or more commonly owned entities).

- Deferral Election

- If a partnership does not elect to defer a gain, a partner may elect its own deferral with respect to the partner’s distributive share of gain. The partner’s 180-day period begins on the last day of the partnership’s taxable year. As an example, a partnership realizes a $1 Million capital gain on March 1. It can elect to defer the gain by investing in a QOF within 180 days (August 28th). In this case, the income will not be reported to the partners. However, if the partnership does not elect to defer the gain, each partner can elect to defer the gain within 180 days of March 1 OR 180 days from the partnership year-end. Based on a December taxable year end, this deferment can be made up until June 29th.

- Support Services

- Locating a lender to fund your commercial mortgage is not as easy as it may seem. Due to the wide range of property types, loan types and special circumstances, a single lender simply cannot offer loan programs for all potential loans. You may waste a considerable amount of time simply trying to find a lender that offers the program you need. A qualified and experienced mortgage broker will have multiple lender relationships in place who can offer a wide range of lending options. Some brokers may even have relationships in place that give you access to hundreds of other lenders offering an unbelievable amount of loan options.

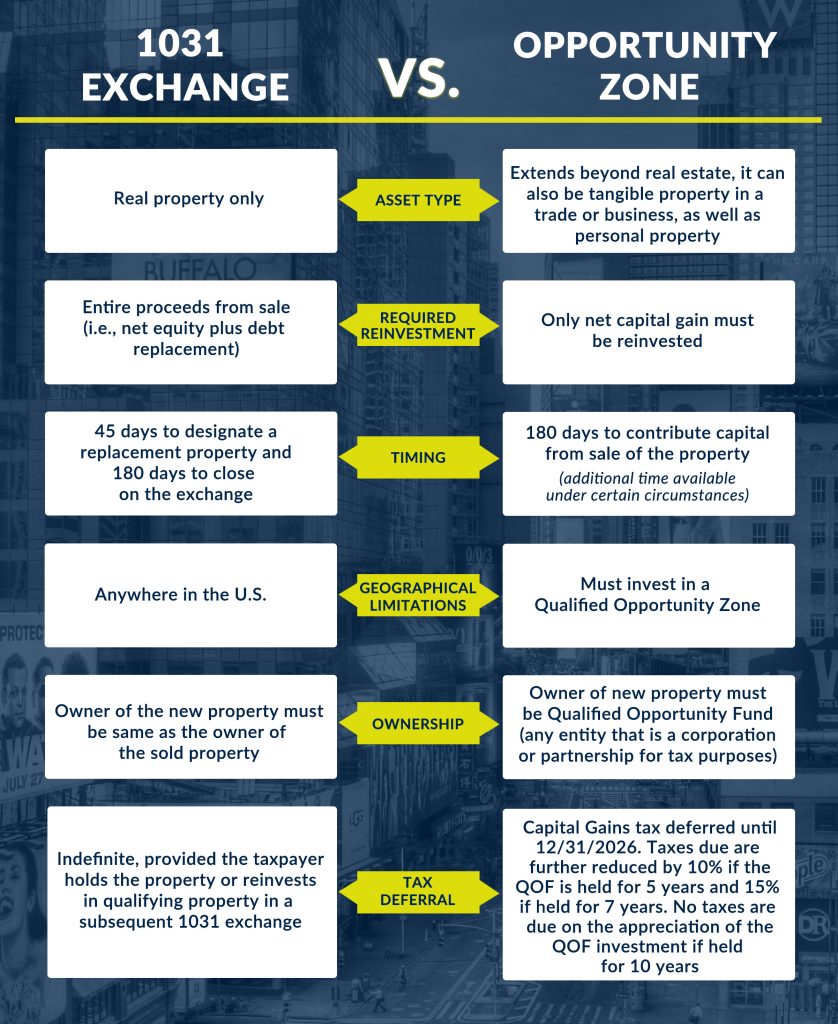

- 1031 Exchange vs Qualified Opportunity Fund

- The major difference between an OZ Investment and a 1031 Exchange is that the OZ program is not limited to real estate. However, if you have sold real estate, you have the option of deferring taxes via a 1031 Exchange or an OZ Investment. After selling a real estate investment property, OZ investors roll only their capital gain into an OZ investment and have the flexibility to consider other investment options with the remaining proceeds. For example, if a real estate investor sells a building for $1 Million, generating a capital gain of $250,000, they can reinvest the $250,000 into an OZ investment, not the entire $1 Million. With a 1031 Exchange, the investor must roll the entire $1 Million into a new investment to enjoy the full tax benefits. The below chart will differentiate the pros and cons of a 1031 Exchange vs a Qualified Opportunity Fund.

A professional commercial mortgage broker will have solid relationships with numerous lenders and will immediately match you up with the best lender based on your needs. Whether you are in need of a construction loan, long term fixed rate loan or bridge loan, a qualified broker will be able to provide guidance in choosing the best lending source. If timing is an issue, the broker will be able to leverage their long term relationship with the lender to garner “express” processing of your request. Everyone needs an advocate at times – a commercial mortgage broker is your advocate in navigating the commercial lending marketplace.

To date, there has been very little guidance from the IRS on exactly how the Opportunity Zone provisions will work. The IRS has announced a self-certification process for establishing Opportunity Zone Funds by simply attaching a self-certification form to the fund’s first-year tax return. The IRS will be providing further guidance covering the rules regarding the treatment of debt and whether investment partnerships can invest their capital in stages to match the development cycle. The next big question is how each State will treat investments in Opportunity Zones for State Tax purposes. Most States have agreed to conform to the IRC as it relates to Opportunity Zones including New Jersey and New York.

The bottom line is that an investment in an Opportunity Zone Property not only provides tax benefits, but if the investment is made prudently with a sound business and or development partner, it can prove to be a diversified wealth building tool.

Progress Capital is working with clients who own properties in Qualified Opportunity Zones. If you have a capital gain or plan to realize a capital gain, give us a call and we can guide you to the right investment opportunities as well as professionals (legal and accounting) who are well versed in the rules regarding Opportunity Zones. Alternatively, if you are a commercial real estate owner with a project in an Opportunity Zone, we may be able to help you with debt and equity to realize your development goals.

The content in this article is intended for informational purposes only and is not intended to provide, and should not be relied upon for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.